The "Industry 4.0 Market by Industry (Aerospace & Defense, Agriculture, Food, Automotive, Chemical, Electronic & Electrical Hardware, Energy, Power, Oil & Gas, Machine Industry, Pharmaceutical & Biotechnology, Semiconductor and Other Industries) - 2018-2023" report from Reportlinker forecasts that the global Industry 4.0 market will reach $214B by 2023. The Industry 4.0 transformation will change long-held dynamics in commerce and global economic balance of power.

The report research team:

- Reviewed and analyzed over 600 Industry 4.0 reports, papers, vendors and governmental information sources

- Participated in 16 round table Industry 4.0 focus groups

- Conducted 75 face-to-face interviews with industry executives

- Conducted a meta research including more than 4,000 industry executives from more than 2,700 companies in 29 countries across 5 continents

- The report research team analyzed each dollar spent in the Industry 4.0 market via five bottom-up research vectors, thus providing a must have mega report for all decision makers in the Industry 4.0 market.

The Industry 4.0 competition is not only about technology or offering the best products, but also, about the companies that gather the best data and combine them to offer the best digital services. Those who know what the customer wants and can forecast consumer demand, will provide the information to develop an "unfair" competitive advantage.

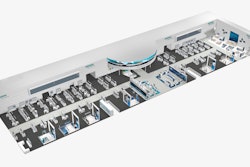

In the next decades, businesses will establish global networks that incorporate their machinery, warehousing systems and production facilities in the shape of Cyber-Physical Systems (CPS). In the manufacturing environment, these cyber-physical systems comprise smart machines, storage systems and production facilities capable of autonomously exchanging information, triggering actions and controlling each other independently. These changes add to the traditional business pressure on manufacturers, but also offer unprecedented opportunities to optimize production processes.

This facilitates fundamental improvements to the industrial processes involved in manufacturing, engineering, material purchasing & usage, supply chain and life cycle management, predictive maintenance and real-time management overview.

The smart factories that have already appeared across most industries employ a completely novel approach to production. Smart products are uniquely identifiable, they can be located at all times, know their own history, current status and alternative routes to achieving their target state.

The embedded manufacturing systems are vertically networked with business processes within factories and enterprises and horizontally connected to dispersed value networks that can be managed in real time from the moment an order is placed right through to outbound logistics. In addition, they both enable and require end-to-end engineering across the entire value chain.

Industry 4.0 holds immense potential. Smart factories allow individual customer requirements to be met and mean that even one-off items can be manufactured profitably. In Industry 4.0, dynamic business and engineering processes enable last-minute changes to production and deliver the ability to respond flexibly to disruptions and failures on behalf of suppliers.

End-to-end transparency is provided over the manufacturing process, facilitating optimized decision-making. Industry 4.0 will also result in new ways of creating value and novel business models. It will provide start-ups and SMEs with the opportunity to develop and provide downstream services.

The major winners might be those that control "Industry 4.0 platforms", software layers that syndicate various devices, information and services, on top of which other firms can build their own offerings.

The transformation of the economy being brought about by Industry 4.0 means that business processes such as supply, manufacturing, maintenance, delivery and customer service will all be connected via the Industrial IoT systems. These extremely flexible value networks will require new forms of collaboration between companies, both nationally and globally.

In 2018-2023, the market will undergo a major transformation through the following drivers:

- Global competition in the manufacturing sector is becoming fiercer and fiercer

- The Nokia syndrome challenge, (by 2007 Nokia smartphone market share was 52%. Nokia's management didn't react to the 2007 launch of the iPhone, leading Nokia to a catastrophic fall in their market share to 2% by 2012).

- "When Industry 4.0 knocks on your door, open it or perish"

- Unprecedented opportunities to optimize production processes

- Governments and the private sector of high labor costs economies invest in Industry 4.0 to increase their industrial base taken by low labor cost countries

- Governments of low labor costs economies invest in Industry 4.0 to maintain their industrial base taken by high labor cost countries Industry 4.0 investments

- Government-funded Industry 4.0 projects, R&D, subsidies and tax incentives

- Industry 4.0 offers start-ups and SMEs the opportunity to develop and provide downstream services

- Industry 4.0 dynamic business and engineering processes enable last-minute changes to production and deliver the ability to respond flexibly to disruptions and failures on behalf of suppliers and customers

- Industry 4.0 provides the link to the consumer, and can forecast consumer demand

The "Industry 4.0 Market by Industry (Aerospace & Defense, Agriculture, Food, Automotive, Chemical, Electronic & Electrical Hardware, Energy, Power, Oil & Gas, Machine Industry, Pharmaceutical & Biotechnology, Semiconductor and Other Industries) - 2018-2023" report is the most comprehensive review of this emerging market available today. It provides a detailed and reasoned roadmap of this rapidly growing market.

The report is aimed at:

- Industry 4.0 products vendors

- Industry 4.0 systems integrators

- Government industry agencies

- Manufacturing companies, SME included

The report has been explicitly customized for the industry and government decision-makers to enable them to identify business opportunities, emerging technologies, market trends and risks, as well as to benchmark business plans.

Questions answered in this 545-page market report include:

- What was the 138 submarkets size and what were the trends during 2016 & 2017?

- What is the 2018-2023 forecast for each of the 138 submarkets?

- Which industries and technologies provide attractive business opportunities?

- What drives the Industry 4.0 managers to purchase solutions and services?

- What are the technology & services trends?

- What are the market SWOT (Strengths, Weaknesses, Opportunities and Threats)?

![Hcm Ax Landcros Press Release[32] jpg](https://img.oemoffhighway.com/mindful/acbm/workspaces/default/uploads/2025/11/hcmaxlandcros-press-release32jpg.mAEgsolr89.jpg?auto=format%2Ccompress&fit=crop&h=100&q=70&w=100)

![Hcm Ax Landcros Press Release[32] jpg](https://img.oemoffhighway.com/mindful/acbm/workspaces/default/uploads/2025/11/hcmaxlandcros-press-release32jpg.mAEgsolr89.jpg?ar=16%3A9&auto=format%2Ccompress&fit=crop&h=135&q=70&w=240)