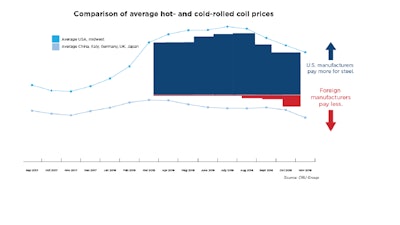

Business Forward Inc. has published its latest American Steel Index report. The monthly report compares the prices American manufacturers and their foreign competitors pay for hot- and cold-rolled steel. U.S. steel prices have risen 7.4% since February, while competitors’ prices have fallen 9.8%.

The difference between U.S. and competitors’ prices is 1.8 times larger since February. American manufacturers are paying 17.2% more than their foreign competitors for hot- and cold-rolled steel.

“President Trump’s tariffs on steel and aluminum are increasing consumer prices and hurting American exports,” explains Business Forward President Jim Doyle. “American manufacturers have started shifting production overseas, and they are cutting back on capital investment. The long-term costs are becoming clear.”

Months of higher steel prices have caused U.S. manufacturers to switch strategies: Now they are importing more finished products and manufacturing less in the U.S. The Business Forward report explains this phenomenon, called “demand destruction.”

“Multiple U.S. manufacturers (that are able to) are planning to shift production elsewhere and import a good with steel rather than manufacture stuff in the U.S.,” says Josh Spoores, Principal Steel Analyst for CRU, a leading steel industry research firm. “In order to have great manufacturing, a country or region must have cheap or affordable materials and energy. The U.S. has energy, but steel is not cheap. You also will see substitution and once that comes, it is challenging for a switch back.”

![Hcm Ax Landcros Press Release[32] jpg](https://img.oemoffhighway.com/mindful/acbm/workspaces/default/uploads/2025/11/hcmaxlandcros-press-release32jpg.mAEgsolr89.jpg?ar=16%3A9&auto=format%2Ccompress&fit=crop&h=135&q=70&w=240)