CNH Industrial N.V. announces consolidated revenues of $6,457 million for the first quarter of 2019, down 5% compared to the first quarter of 2018 (up 2% on a constant currency basis). Net sales of Industrial Activities were $6,006 million in the first quarter of 2019, down 5% compared to the first quarter of 2018 (up 2% on a constant currency basis). Net income was $264 million in the first quarter of 2019 ($202 million in the first quarter of 2018) and included a pre-tax gain of $30 million ($22 million net of tax impact) as a result of the amortization over approximately 4.5 years of the $527 million positive impact from the 2018 U.S. healthcare plan modification.

Adjusted net income was $248 million for the first quarter of 2019 compared to $204 million in the first quarter of 2018. Adjusted diluted EPS was $0.18 in the first quarter of 2019, up 29% compared to the first quarter of 2018.

Adjusted EBIT of Industrial Activities was up 7% to $278 million in the first quarter of 2019 compared to $261 million in the first quarter of 2018, with an adjusted EBIT margin of 4.6%, up 50 basis points (bps).

Adjusted EBITDA of Industrial Activities was $525 million in the first quarter of 2019, down 4% compared to the first quarter of 2018, with an adjusted EBITDA margin of 8.7%, flat compared to the first quarter of 2018.

Income taxes were $90 million in the first quarter of 2019 ($63 million in the first quarter of 2018). Adjusted income taxes for the first quarter of 2019 were $84 million ($64 million in the first quarter of 2018). The adjusted effective tax rate (adjusted ETR) was 26%, flat compared with the first quarter of 2018. For the full year 2019, the adjusted ETR is expected to be approximately 27%.

Net industrial debt of $1.5 billion at March 31, 2019 increased by $0.9 billion from December 31, 2018 primarily as a result of normal seasonal increase in working capital in the first quarter. Total debt was $23.8 billion at March 31, 2019, down $0.6 billion compared to December 31, 2018. At March 31, 2019, available liquidity was $10.0 billion, up $1.1 billion compared to December 31, 2018.

In March, CNH Industrial signed a €4 billion committed revolving credit facility, replacing an existing 5-year €1.75 billion facility. The new credit facility has a 5-year tenor with two extension options of 1-year each, exercisable on the first and second anniversary of the signing date.

In March, CNH Industrial Finance Europe S.A. issued €600 million in principal amount of 1.75% notes due 2027 and guaranteed by CNH Industrial N.V.

Segment Results

Agriculture’s net sales decreased 4% in the first quarter of 2019 compared to the first quarter of 2018, but were up 2% on a constant currency basis. Improved sales volume from end-user replacement demand in the North America row crop sector, and from sustained demand in Brazil, coupled with strong price realization performance across all geographies, were partially offset by a general slowdown of activity in Turkey and by extremely dry weather affecting harvest conditions in Australia.

Adjusted EBIT was $168 million in the first quarter of 2019 ($186 million in the first quarter of 2018), with adjusted EBIT margin at 6.7%. Accelerated investment in its precision farming platform and the introduction of Stage V emission requirements-compliant engine applications increased the segment’s product development spending by 19% (in constant currency) compared to the first quarter of 2018. Net of this increase, segment performance improved as a result of price realization achieved, in excess of raw material headwinds and the impacts in the period from the enactment of the U.S. tariffs with respect to China.

Construction’s net sales decreased 6% in the first quarter of 2019 compared to the first quarter of 2018, down 2% on a constant currency basis mainly due to selective inventory destocking actions in the company's North American dealer network.

Adjusted EBIT was $13 million in the first quarter of 2019 (breakeven in the first quarter of 2018) with an adjusted EBIT margin of 2.0%. The increase in profit was the result of net price realization across the product portfolio and production efficiencies, more than offsetting raw material and tariff headwinds.

Commercial and Specialty Vehicles’ net sales decreased 3% in the first quarter of 2019 compared to the first quarter of 2018 (up 5% on a constant currency basis). Higher industry volume and favorable product mix in light commercial vehicles and in buses in Europe were more than offset by the negative impact of foreign currency translation.

Adjusted EBIT was $51 million in the first quarter of 2019, slightly up compared to $49 million in the first quarter of 2018. Positive volume in light trucks and buses, favorable product mix and a positive underlying price performance were almost offset by negative foreign exchange transaction and year-over-year hedge impacts, higher production costs including negative absorption from lower volumes in medium- and heavy-duty operations, and increased product development spending. Adjusted EBIT margin was 2.1% in the first quarter of 2019 (up 10 bps compared to the first quarter of 2018).

Powertrain’s net sales decreased 13% in the first quarter of 2019 compared to the first quarter of 2018, down 6% on a constant currency basis due to lower sales volume as a result of strong 2018 year-end activity. Sales to external customers accounted for 47% of total net sales (48% in the first quarter of 2018).

Adjusted EBIT was $96 million in the first quarter of 2019 ($95 million in the first quarter of 2018). Favorable product mix and manufacturing efficiencies were offset by increased sales development expenses in support of the segment’s marketing activity to further expand third party business, and higher product development spending. Adjusted EBIT margin increased 130 bps to 9.3% in the first quarter of 2019, which represents a first quarter record for the segment.

Financial Services’ revenues totaled $474 million in the first quarter of 2019, a 6% decrease compared to the first quarter of 2018 (down 1% on a constant currency basis), primarily due to lower used equipment sales in North America, partially offset by higher average portfolio in South America and Rest of World.

In the first quarter of 2019, retail loan originations (including unconsolidated joint ventures) were $2.2 billion, flat compared to the first quarter of 2018. The managed portfolio (including unconsolidated joint ventures) was $26.1 billion as of March 31, 2019 (of which retail was 61% and wholesale 39%), down $0.4 billion compared to March 31, 2018. Excluding the impact of currency translation, the managed portfolio increased $1.2 billion compared to the same period in 2018.

Net income was $95 million in the first quarter of 2019, a decrease of $8 million compared to the first quarter of 2018, primarily attributable to reduced interest spreads, partially offset by improved cost of risk and operating lease performance, as well as higher average portfolios in South America and Rest of World.

2019 Outlook

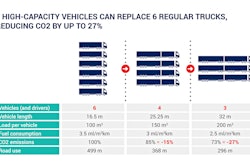

The general sentiment in the agricultural end-markets remains muted in the short-term, primarily as a result of uncertainties related to unresolved trade tensions, the spillover implications of recent negative weather events (Australia and Northern Europe), and geopolitical and macroeconomic uncertainties. Positive indications exist in the North American non-residential construction industry, as well as in the healthy end-user demand in Europe for light-duty trucks, and the acceleration of the LNG heavy-duty trucks penetration. In this complex and composite scenario, the Company confirms it is on track with its profitable growth trajectory and is therefore reaffirming its 2019 guidance as follows:

- Net sales of Industrial Activities at approximately $28 billion, modestly up year-over-year;

- Adjusted diluted EPS(2) up year-over-year between 5% and 10% at a range of $0.84 to $0.88 per share;

- Net industrial debt at the end of 2019 between $0.4 billion and $0.2 billion.