The Timken Company, a world leader in engineered bearings and mechanical power transmission products, has reported second quarter 2017 sales of $750.6 million, up 11.4% from the same period a year ago and up 6.6% from the first quarter. The year-over-year increase in sales reflects improved demand across industrial end markets led by off-highway and industrial distribution, as well as the benefit of acquisitions, partially offset by continued weakness in rail.

In the second quarter, Timken posted net income of $82.5 million or $1.04 per diluted share, versus net income of $48.2 million or $0.61 per diluted share for the same period a year ago. The current period includes a net benefit of approximately $30 million related to adjustments to accruals for prior-year taxes, while the year-ago period included CDSOA income of approximately $4 million after tax. The year-over-year change in net income also reflects the favorable impact of higher volume and acquisitions, partially offset by unfavorable price/mix, and higher material, logistics and selling, general and administrative (SG&A) costs.

Excluding special items, adjusted net income in the second quarter of 2017 was $54 million or $0.68 per diluted share, up from $46.8 million or $0.59 per diluted share for the same period in 2016. The increase in adjusted net income reflects the favorable impact of higher volume and acquisitions, partially offset by unfavorable price/mix and higher material, logistics and SG&A costs. The company generated cash from operations of $67.8 million and free cash flow of $47.2 million in the second quarter of 2017.

"Most of our end markets continued to strengthen sequentially from the first quarter. We responded well by delivering strong sales and earnings growth with margin expansion in Process Industries," says Richard G. Kyle, Timken President and Chief Executive Officer. "We also advanced our strategy by completing several acquisitions and continuing to invest organically in our product lines and manufacturing capabilities in the quarter."

Among recent developments, the company:

- Began shipments from its new, state-of-the-art tapered roller bearing plant in Romania;

- Completed the acquisition of PT Tech, adding a new category of industrial clutches and brakes to its mechanical power transmission portfolio;

- Completed the acquisition of Groeneveld Group, a leading provider of automatic lubrication solutions used in on- and off-highway applications, significantly growing Timken's presence in this space;

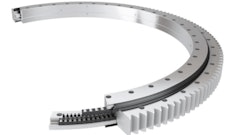

- Entered into a definitive agreement to acquire ABC Bearings Ltd., a manufacturer of roller bearings and slewing rings in India, to serve domestic and export markets;

- Increased the company's quarterly dividend by 4% to 27 cents per share; and

- Was named one of America's Best Large Employers by Forbes magazine for the second consecutive year in a row.

Second-Quarter 2017 Segment Results

Mobile Industries reported sales of $408.4 million, up 11% compared with the same period a year ago, with higher shipments in the off-highway, aerospace and heavy truck sectors, as well as the benefit of acquisitions, partially offset by declines in the rail sector.

Earnings before interest and taxes (EBIT) in the quarter were $34.4 million or 8.4% of sales, compared with EBIT of $37.4 million or 10.2% of sales for the same period a year ago. The decrease in EBIT primarily reflects higher material, logistics and SG&A costs and unfavorable price/mix, partially offset by the favorable impact of higher volume and acquisitions.

Excluding special items, adjusted EBIT in the quarter was $35.9 million or 8.8% of sales, compared with $39.7 million or 10.8% of sales in the second quarter last year.

Process Industries reported sales of $342.2 million, up 11.9% from the same period a year ago, driven primarily by increased demand in the industrial distribution and heavy industries sectors and the benefit of acquisitions.

EBIT for the quarter was $60.2 million or 17.6% of sales, compared with EBIT of $47.9 million or 15.7% of sales for the same period a year ago. The increase in EBIT was driven by the favorable impact of higher volume, manufacturing performance and acquisitions, partially offset by unfavorable price/mix and higher SG&A expenses.

Excluding special items, adjusted EBIT in the quarter was $60.2 million or 17.6% of sales, compared with $48.9 million or 16% of sales in the second quarter last year.

2017 Outlook

"As a result of stronger end-market demand, recent acquisitions and the advancements we've made in our business, we are raising our full-year revenue and earnings outlook for 2017," says Kyle. "In the second half, we expect to deliver double digit year-on-year growth in revenue and EPS while expanding margins and delivering strong free cash flow."

The company now expects 2017 revenue to be up approximately 11% in total versus 2016. Within its segments, the company estimates full-year 2017:

- Mobile Industries sales to be up 11-12%, driven by the benefit of acquisitions and improved demand in the off-highway and heavy truck sectors, partially offset by continued weakness in the rail sector.

- Process Industries sales to be up 10-11%, reflecting growth across most end-market sectors and the benefit of acquisitions.

Timken now anticipates 2017 earnings per diluted share to range from $2.60 to $2.70 for the full year on a GAAP basis, which does not include the impact of any potential mark-to-market pension remeasurement adjustments in the second half.

Excluding special items (detailed in attached tables), the company expects 2017 adjusted earnings per diluted share to range from $2.50 to $2.60.