Manufacturers in the $200 billion construction equipment market face a complex challenge. They must reduce their dependence on diesel fuel and move to lower emission technologies. At the same time, they must continue to supply the performance customers expect, while ensuring that the total cost of ownership (TCO) makes the adoption of these cleaner machines viable.

Electrification will undoubtedly play an important role in enabling construction firms to deliver on their environmental targets. IDTechEx's new report "Electric Vehicles in Construction 2022-2042", authored by Dr. David Wyatt, technology analyst, provides a comprehensive assessment of current progress in this emerging sector with case study detail and background on key enabling technologies.

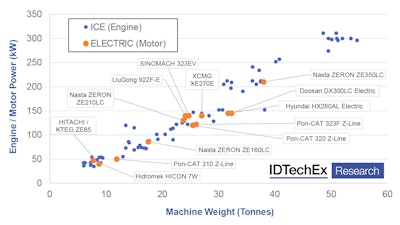

To undertake the same tasks as equivalent diesel machines, powertrain elements in electric construction equipment need to be sized to deliver the same performance. This requires that the motor and battery specification is correctly dimensioned. Therefore, the key to the deployment of electric machines is understanding their typical daily duty cycle power and energy demands.

As the construction industry employs different off-road mobile machines, the maximum motor power requirement varies depending on the application and size of equipment. Likewise, the total daily energy requirement is governed by the use case for the machine. Some duty cycles need only sporadic operation during the day, while other machines operate nearly continuously. Modular systems are required to optimize electric machine performance and cost.

Starting Small

Most manufacturers, especially in the U.S. and Europe, focused their initial electrification development work on compact construction equipment. Their small size and relatively light-duty cycle requirements mean a typical eight-hour workday can be met with a practical size of Li-ion battery (less than 50 kWh) and electric motor (less than 20 kW).

Several potential avenues for charging these machines are being explored including:

- Large battery solutions, which can deliver a full workday without recharging

- Smaller batteries with opportunity for fast charging during the workday

- Tethered cable operation

- Battery swapping

The optimal battery size for each machine will need to balance factors such as:

- The high cost of off-road battery packs

- The impact of fast charging on battery life

- The availability of a steady electricity supply

- The cost of installing charging infrastructure on worksites

Strategy for Bigger Machines

While small machines are a natural starting point for electrification in this market, heavier construction machines contribute the most to the sector's CO2 emissions. It is vital that OEMs also deliver zero-emission solutions for these larger vehicles.

The problem lies in the fact that machines such as large excavators can demand more than 75 kWh of energy per hour of operation. This means installing a huge battery where a continuous eight-hour shift is demanded. With current heavy-duty off-road Li-ion battery pack prices nearing more than $600 per kWh, these enormous batteries' cost hinders the TCO viability.

Developing a charging strategy for bigger machines will be key to reducing the requirement for installed battery capacity. Different approaches are being explored. For instance, many Chinese OEMs have opted for a dual gun DC fast charging method, which can add 300 kWh during a lunch break, while Dutch cleantech engineering firm Urban Mobility Systems (UMS) has developed a battery swapping system that uses three 130-kWh battery modules. The UMS system has been tested in large Doosan and Hyundai excavators.

All-Electric Emerging

Improving powertrain efficiency will also be crucial. Almost all current electric construction equipment has replaced the diesel engine with batteries and electric motors but still employ a standard hydraulic system, which can be as little as 30% efficient. To address this, companies like Danfoss are developing digital hydraulic technology that improves powertrain efficiency and reduces energy consumption. The result is that a smaller battery can be used to deliver the same day's work.

The end goal for electric construction machines is all-electric systems, entirely replacing hydraulics and, in their place, using electric actuators and drive motors. Doosan Bobcat launched an all-electric track loader, the T7X, at CES 2022. Developed with Viridi Parente and Moog, the efficiency improvement of the all-electric system allows for the use of a 62-kWh battery. If the vehicle employed hydraulics, the battery would have needed a capacity of more than 300 kWh to deliver the same endurance.

Further development work in the next decade is needed to see all-electric systems deployed more widely. Electric actuators are currently expensive, and they are not yet able to meet the demands of larger construction equipment.

Innovation is required to deliver electrification across this challenging sector, and forward-thinking companies are already committing effort and resources to meeting these challenges. IDTechEx forecasts that the electric share of the construction vehicle market will be worth more than $100 billion per year by 2042.