Steve Hornyak, president and CEO at Turntide TechnologiesTurntide Technologies

Steve Hornyak, president and CEO at Turntide TechnologiesTurntide Technologies

1. What challenges most affected the mobile OEM landscape in 2024?

As in past years, finding and retaining talented, experienced engineers continues to be a challenge for component manufacturers and equipment and vehicle OEMs. Currently, the demand is outpacing available personnel.

In addition, meeting emission regulations is another hurdle. However, as the electric charging infrastructure matures (with the assistance of electric vehicle and equipment manufacturers), the move to electric drivetrains will increase.

We are also seeing that OEMs are trying to maximize the investment in current platforms. Therefore, they want an evolutionary vs. a revolutionary approach to electrification, which is more time consuming but saves in short-term capital expenditures

2. What are your predictions for the mobile OEM landscape in 2025?

During the last couple years, the development of battery-electric vehicles and equipment has slowed, but the trajectory has continued upward, just at a slower pace. In 2025, our team predicts that this trajectory will speed up again due to economies of scale, infrastructure and lower total cost of ownership.

Another trend we see is the move to axial flux motors for hybrid and electric systems. Axial flux motors are a gamechanger for weight- or space-constrained applications. They are flatter, often called pancake motors, which is why they are ideal when space is at a premium.

Regarding weight, the torque of an axial flux motor is proportional to the square of the diameter multiplied by the length. For an axial flux machine, the torque is proportional to the cube of the diameter, and it has no noteworthy influence on the length. Because of this, a smaller axial flux machine can provide more torque than a larger radial flux machine. If the equipment design requires high torque and power delivery and low motor weight and volume, an axial flux motor is the ideal choice.

3. In what area(s) do you see the most potential for acceleration or advancement in 2025?

An improved infrastructure is on the horizon. This will accelerate in 2025, opening the door for the increased adoption of hybrid and electric systems. Battery-electric power is the most accessible power alternative right now. The other zero-emission and lower emission options, including hydrogen, hydrotreated vegetable oil and other biodiesels, do not currently have much infrastructure and cannot currently scale geographically.

Another trend, as mentioned before, is adopting axial flux motors. This technology will help OEMs implement hybrid and electric systems with flatter, lighter motors providing more torque and power than radial flux motors. They will help accelerate many OEMs’ move to hybrid or electric systems.

4. What will be the biggest challenge for OEMs and the industry in general in 2025?

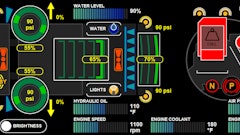

Perhaps the biggest challenge for OEMs will be selecting components for hybrid and electric systems that operate together effectively and efficiently. While many manufacturers provide one or two components for these systems, few provide all the equipment needed (motors, inverters, cooling systems and batteries).

5. What factors should engineers and their companies consider when making decisions in the mobile OEM space in 2025?

To ensure that a hybrid or electric system operates efficiently, engineers and OEMs should work with a provider with a systems-level approach. This approach focuses on integrating electric motors, power electronics, thermal control and energy storage solutions into a unified ecosystem. In general, there is strong pull for more sustainable and emissions-lowering technology. If it’s not already a consideration, OEMs would be wise to begin evaluating how it should play a role in their decision-making.

6. Please highlight a recently introduced product from your company that meets a specific, pressing need in the mobile OEM space, and describe briefly how the product is uniquely designed to meet that need.

Turntide Technologies recently introduced its Gen 6 inverters. They are an exceptional range of air-cooled inverters with one of the highest power densities of its type currently available. Capable of supporting all permanent magnet synchronous machines and alternating-current induction motors, it is a first choice for all low-voltage electrification applications below 150 volts in a small footprint.

Gen 6 inverters are suitable for electric traction and ancillary control on mobile equipment applications, which include two- and three-wheel mobility, last-mile delivery, golf buggies, autonomous guided vehicles, other material handling equipment, airport ground support equipment, aerial platforms, and construction machinery.

7. What are some of your company's priorities in 2025 with regard to electrification, automation, innovation, emission reduction and/or other emerging trends?

One of our goals is to take axial flux motors to a higher level of use. Many engineers and designers consider them niche motors. But they can be used in almost anything that moves. Their light weight and small footprint allow engineers to provide the same torque and power with a smaller, more efficient motor. We anticipate that axial flux motors will become the standard for hybrid and electric applications.

One of the main inhibitors to the adoption of axial flux motors has been price, historically two times the price of traditional motors, primarily resulting in specialty and niche application of these motors. However, we have leveraged many years of experience to realize a breakthrough in design and engineering that allows us to price our motors at a slight premium to legacy motors, opening the majority market for mass adoption of this more efficient and effective motor.