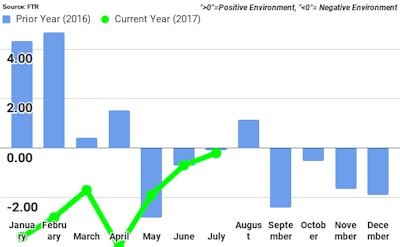

FTR’s Shippers Conditions Index (SCI) for July continued near zero, at a reading of -0.1, reflecting the dominance of contract pricing to the measure. While capacity is tightening noticeably, sharp segmentation trends have pushed the majority of market stress into spot markets. FTR forecasts further declines in this index during 2017 and 2018 as spot market prices continue to surge, with smaller - but notable - increases coming for the contract market. FTR has modestly revised its late year economics on improved expectations for investment and manufacturing. Hurricane recovery is expected to contribute additional stimulus several months out.

Jonathan Starks, Chief Operating Officer at FTR, comments, “Market conditions through the summer remained relatively subdued, but the environment has changed considerably since then. Prior to Hurricane Harvey, spot market rates were nearing gains of 20% year-over-year. The latest week puts gains approaching 30%. This will put significant pricing pressure on the contract portion of the market as we move into the fourth quarter. Hurricane disruptions will slowly subside over the next month, but recovery activity will stay elevated for several months. Combine that with the upcoming ELD implementation, elevated fuel prices, and modest acceleration in overall freight demand, and we have a market that is likely to turn much more negative as we finish off 2017 and move into 2018.”