CNH Industrial N.V. announces consolidated revenues of $6,630 million for the third quarter of 2017, up 15.3% compared to the third quarter of 2016. Net sales of Industrial Activities were $6,331 million in the third quarter of 2017, up 15.9% compared to the third quarter of 2016. Net income was $57 million for the third quarter of 2017 and includes $53 million of restructuring charges as part of the company's Efficiency Program. It also includes a charge of $39 million related to the September 2017 repurchase of an aggregate nominal amount of €800 million of the outstanding CNH Industrial Finance Europe S.A. Notes due 2018 and 2019. Adjusted net income was $148 million for the third quarter compared to $68 million in the third quarter of 2016. Adjusted diluted EPS in the third quarter was $0.11, up 120% compared to the third quarter of 2016.

Operating profit of Industrial Activities increased 41% to $351 million for the third quarter of 2017 compared to the $248 million in the third quarter of 2016, with an operating margin of 5.5%, up 1.0 percentage points (p.p.) compared to the third quarter of 2016.

Income taxes were $64 million in the third quarter of 2017 ($32 million in the third quarter of 2016). Adjusted income taxes for the third quarter of 2017 were $65 million ($47 million in the third quarter of 2016). The adjusted effective tax rate (adjusted ETR) was 34%, down from 46% in the third quarter of 2016, primarily due to favorable changes in our jurisdictional profit mix.

Net industrial debt was $2.6 billion at September 30, 2017, up $0.5 billion compared to June 30, 2017, due to the typical seasonal increase in net working capital. Total debt was $25.5 billion at September 30, 2017, in line with June 30, 2017. At September 30, 2017, available liquidity(1)(2) was $7.9 billion, down $0.4 billion compared to June 30, 2017.

During the quarter, CNH Industrial Finance Europe S.A. issued €650 million in principal amount of 1.750% Notes due 2025. In addition, CNH Industrial Finance Europe S.A. repurchased €347 million of its outstanding €1.2 billion 6.250% Notes due 2018, and €453 million of its outstanding €1.0 billion 2.750% Notes due 2019. The $39 million one-time charge related to the repurchase of the Notes will be offset by interest cost savings achieved through the remaining original term of the notes. In addition, the company has announced the early redemption of all of the outstanding $600 million in principal amount of CNH Industrial Capital LLC 3⅞% Notes due July 2018.

On October 24, 2017, Fitch Ratings assigned CNH Industrial N.V. and CNH Industrial Capital LLC long-term issuer default ratings of "BBB-". The outlook of both companies is stable. Fitch Ratings also assigned a short-term issuer default rating to CNH Industrial Capital LLC of "F3". This rating action follows the upgrade of Standard and Poor's, on June 15, 2017, of the long-term corporate rating of CNH Industrial N.V. and CNH Industrial Capital LLC to "BBB-" with stable outlook. These two actions will make the Company's securities eligible for the main investment grade indices in the U.S. market.

Segment Results

Agricultural Equipment's net sales increased 12.4% in the third quarter of 2017 compared to the third quarter of 2016 (up 9.4% on a constant currency basis). Net sales increased in EMEA, primarily due to improved volume for combines and low horsepower tractors and to favorable net price realization. Net sales also increased in APAC, mainly in India, and in LATAM, mainly in Brazil and Argentina. Net sales in NAFTA were flat, as stable row crop market conditions and improved tractor mix were offset by reduced market demand for hay and forage products.

Operating profit was $208 million in the third quarter of 2017, a 34% increase over the $155 million in the third quarter of 2016. Operating margin increased 1.2 p.p. to 7.8% as a result of the favorable volume and product mix, the positive net price realization more than offsetting raw material cost increases, and improved quality costs, while the company increased its investments in research and development.

Construction Equipment's net sales increased 7.9% in the third quarter of 2017 compared to the third quarter of 2016 (up 6.0% on a constant currency basis), driven by market growth in all regions, particularly in light equipment in NAFTA and in APAC, where CNH has seen a sustained rebound in demand since last year. The current worldwide order book is over 50% higher than the previous year.

Operating profit was $13 million in the third quarter of 2017, a $12 million increase compared to the third quarter of 2016, with an operating margin of 2.0% (up 1.8 p.p. compared to the third quarter of 2016). The increase was mainly driven by higher volumes and favorable product mix, as well as slightly positive price realization.

Commercial Vehicles' net sales increased 20.0% in the third quarter of 2017 compared to the third quarter of 2016 (up 14.7% on a constant currency basis). In EMEA, net sales increased as a result of price realization, fleet-related sales of heavy tractor trucks and commercial vans, and timing of specialty vehicle deliveries. In LATAM and APAC, net sales improved as a result of favorable industry trends in Argentina, Turkey, and Australia.

Operating profit was $59 million for the third quarter of 2017 ($64 million in the third quarter of 2016), with an operating margin of 2.3% (down 0.7 p.p. compared to the third quarter of 2016), and was affected by unfavorable product and channel mix, more than offsetting the favorable volume impact, as well as increased investments in research and development on new product programs. The price realization achieved was more than offset by Euro 6 emissions content costs and the impact of the devaluation of the British pound. In general, pricing conditions in the main European markets remained very competitive during the quarter.

At the end of the quarter, the company initiated additional capacity realignments in its firefighting business as part of the Efficiency Program. The company recognized a total pre-tax restructuring charge of $47 million, of which $14 million is non-cash charge, and will result in $18 million of total annual pre-tax savings which the company anticipates will be fully realized by 2019.

Powertrain's net sales increased 26.5% in the third quarter of 2017 compared to the third quarter of 2016 (up 20.4% on a constant currency basis), due to higher sales volumes with both captive and external customers. Sales to external customers accounted for 48% of total net sales, in line with the third quarter of 2016.

Operating profit was $88 million for the third quarter of 2017, a $36 million increase compared to the third quarter of 2016 as a result of higher volume, favorable engine mix, and manufacturing efficiencies. Operating margin increased 2.1 p.p. to 8.2%, the highest third quarter margin ever reported in the segment's history, reflecting the profitability of a well-balanced portfolio of engine applications.

Financial Services' revenues totaled $409 million in the third quarter of 2017, an increase of 6.0% compared to the third quarter of 2016 (up 3.4% on a constant currency basis), due to higher activity in LATAM and APAC. Retail loan originations (including unconsolidated joint ventures) were $2.3 billion, flat compared to the third quarter of 2016. The managed portfolio (including unconsolidated joint ventures) was $26.0 billion as of September 30, 2017 (of which retail was 63% and wholesale 37%), up $1.2 billion compared to September 30, 2016 (up $0.5 billion on a constant currency basis).

Net income was $86 million in the third quarter of 2017, an increase of $9 million compared to the third quarter of 2016, primarily due to the higher activity in LATAM and APAC, lower provisions for credit losses, and the positive impact of currency translation.

2017 Outlook

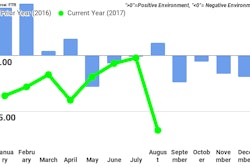

Market conditions across major segments have been solid year-to-date, despite continued inventory destocking efforts in high horsepower tractors in the NAFTA row crop market segment and weakened demand in hay and forage products. The weakening of the U.S. dollar against most of the company's trading currencies, especially the euro, has had a positive translation impact on revenues. However, the strengthening of the euro has had an unfavorable translation impact on the euro-denominated portion of net industrial debt. The exchange impacts on profit have been less significant due to balanced foreign currency positions between revenue and costs. Therefore, the company is increasing its 2017 guidance for sales and EPS, and is slightly increasing the net industrial debt guidance as follows:

- Net sales of Industrial Activities of $25.0 to $25.5 billion;

- Adjusted diluted EPS of $0.44 to $0.46;

- Net industrial debt at the end of 2017 at $1.5 to $1.7 billion.

![Hcm Ax Landcros Press Release[32] jpg](https://img.oemoffhighway.com/mindful/acbm/workspaces/default/uploads/2025/11/hcmaxlandcros-press-release32jpg.mAEgsolr89.jpg?ar=16%3A9&auto=format%2Ccompress&fit=crop&h=135&q=70&w=240)