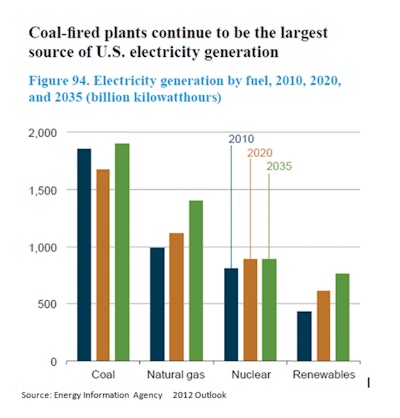

Coal and other hydrocarbon fuels have been the go-to fuel for power generation the entire nineteenth century and will likely remain dominant well into the future.

It is a fact that natural gas has negatively affected coal demand and therefore coal prices. The U.S. share of electricity generated by coal in fell in March (most recent data available) to 34%. Meanwhile, natural gas-fired generation increased to 40% in March. Coal prices have declined as a result.

In the U.S. benchmark, central Appalachian thermal coal prices fell from near $70 a metric ton at the start of this year, to approximately $54 a metric ton recently, down 23%. It’s interesting to note that although coal consumption dropped a relatively small 4.6%, it caused a huge swing in coal prices.

Economists would say that coal prices are very elastic; that is, they react to changes very disproportionately. As a result of declines in coal consumption by electric power plants, March coal stockpiles were about 196 million tons, almost 18% above the level in March 2011.

Coal and natural gas are locked in what appears to be a race-for-the-bottom death struggle, pulling each other down as electric power plants switch from coal to natural gas. Switching a coal-fired electric plant to natural gas is semi-permanent. As one analyst said, it’s not as simple as turning on a light switch. There's downtime and cost associated with the switchover, therefore, coal and natural gas production will not swing wildly as prices fluctuate.

“This is an opportune time to switch from coal to natural gas,” says Moran Zhang, an investment analyst. “The EPA has enacted a pair of clean-air rules over the past year that tightened limits on power-plant emissions of sulfur dioxide and nitrogen dioxide, and place new limits on mercury. In what could be an even bigger environmental blow to coal, the EPA in March issued guidelines that could limit greenhouse gas emissions from new power plants.”

To read more about the EPA clean air rules, go to OEM Off-Highway’s blog, Manufacturing Matters, at www.oemoffhighway.com/ 10686792.

According to Marin Katusa at Casey Research, “horizontal drilling and multi-stage fracturing has unlocked trillions of cubic feet of natural gas from shale gas formations across North America. The market is flooded with gas – too much gas for the current level of demand. And as supply and demand have searched for equilibrium, gas prices that traded as high as $13 per MMBtu (one million Btus) just four years ago have dropped as much as 85%. In April, natural gas prices reached a low of $1.90 MMBtu. By July, the price rebounded to $2.49 MMBtu, but it is still considered cheap and has curtailed some new drillers from starting new projects.”

The pressure on coal companies is staggering. For example, Arch Coal, Inc. announced plans to idle several operations and to reduce production at other mining complexes in Appalachia due to the unprecedented downturn in demand for coal-based electricity. The action will result in a total workforce reduction of approximately 750 full-time employee positions. "Current market pressures and a challenging regulatory environment have pushed coal consumption in the United States to a 20-year low," said John W. Eaves, Arch's president and chief executive officer.

Five years ago, coal represented 50% of electricity generation, and natural gas was less than 20%. The Energy Information Agency (EIA) projects by 2030 natural gas will take over almost half of the national fuel mix. However, according to the EIA, coal will continue to represent a huge percentage of the U.S. energy mix.

Historically, when the price of natural gas declined, the management for utility companies always considered these price fluctuations as temporary, due perhaps to mild temperatures or other factors. Management of power generation companies were reluctant to make the switch because they feared that as soon as they shifted from coal to natural gas, prices would rise if it was a very cold winter. This time, however, it is different due to abundant cheap supplies and environmental regulations that favor gas. Analysts at the EIA believe it is likely that coal production will be under pressure for four years, after which it will begin growing again.

U.S. power generators have taken advantage of low natural gas prices by making more use of gas-fired plants that had previously been used to serve peak-power demand. Other utility companies operate combined-cycle coal-gas plants that can burn either fuel. However, according to one analyst, the switchover phase is almost complete. Utilities have transitioned their combined cycle plants, restarted their idled gas capacities and committed as much to new gas plants as they are willing to commit given natural gas’ price volatility.

Alternative Fuels

What about alternative fuels, government funding for solar panel companies and subsidies for ethanol products? As illustrated in the Consumption by Fuel chart, all of the alternative fuels combined represented less than 2% of all electric consumption in 2011. The EIA estimates that by 2035 the use of alternate fuels will increase but will still represent a very small portion of our total energy mix, maybe reaching 4%. The good news is that there are many alternative energy sources being worked on. The bad news is that none of them store as much energy as hydrocarbon fuels. Until someone discovers an incredible new battery technology, society will be dependent on hydrocarbon fuels. As Saul Griffith, recipient of a MacArthur Fellow genius grant states, “Unfortunately, the difference between the world’s best battery and gasoline, in terms of energy storage per kilogram, is not a factor of ten; it’s more like a factor of hundreds or thousands.”

Griffith went on to say:

The human race currently consumes energy at an average rate of approximately [16] trillion watts, or [16] terawatts – the equivalent of [160] billion hundred watt light bulbs burning all the time. Capping greenhouse gas at a level that climatologists hope only raises global temperatures by two degrees Celsius would necessitate replacing all but three of those [16] terawatts with the equivalent of the following: [100] square meters of new solar cells, [50] square meters of new solar thermal reflectors, and one Olympic swimming pool’s volume of genetically engineered algae (for biofuels) every second for the next 25 years; one 300 foot diameter wind turbine every five minutes; [100] megawatt geothermal powered steam turbines every eight hours; and one three gigawatt nuclear power plant every week.”

The U.S. coal mining, natural gas and oil industries can be assured of continued prosperity with some bumps along the way created by market forces and government intervention schemes.