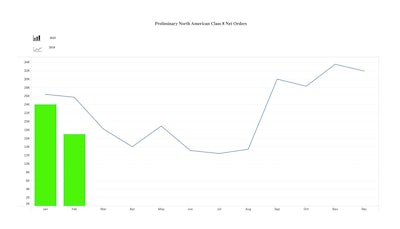

FTR reported North American Class 8 net orders in February totaled 17,000 units, down 31% month-over-month (m/m) and 38% year-over-year (y/y). This figure was well below seasonal expectations, falling notably short of the seven-year February average of 26,912 net orders. With continuous threats of significant tariffs among the North American trading partners and increasing uncertainty for market participants, business investment directed towards Class 8 trucks/tractors appears to have slowed significantly. For the first time since the 2025 order season began, cumulative net orders from September 2024 through February 2025 have declined 3%. Class 8 orders have totaled 266,900 units over the last 12 months.

Original equipment manufacturers (OEMs) across the board experienced a significant decline in order activity for February. The on-highway market accounted for the bulk of the declines, although vocational orders were also down notably.

Dan Moyer, senior analyst, commercial vehicles, said, “Significant U.S. tariffs could substantially increase costs for North American Class 8 trucks/tractors and related components. Approximately 45% of all Class 8 trucks built for the U.S. and Canadian markets will be subject to the 25% U.S. tariff on all imports from Canada and Mexico and planned Canadian counter tariffs. About 40% of U.S. Class 8 trucks are produced in Mexico, and roughly 65% of Canada’s Class 8 trucks are assembled in the U.S. Even if those tariffs went away, others affecting costs include those on steel and aluminum, goods imported from China, and perhaps others coming down the pike.”

He added, “Combined with upcoming U.S. EPA 2027 NOx regulations, tariffs may significantly disrupt fleet replacement cycles – either accelerating investments to avoid future price hikes or delaying purchases amid growing uncertainty. Based on February orders, the latter approach apparently is the dominant path so far. OEMs and suppliers may consider shifting production to manage tariff exposure. However, these strategic changes remain costly, complex, and time-intensive, further complicating industry planning.”