Caterpillar Inc. announces profit per share of $0.93 for the second quarter of 2016, a decrease from $1.31 per share in the second quarter of 2015. Excluding restructuring costs, profit per share was $1.09, down from $1.40 per share in the second quarter of 2015. Second-quarter 2016 sales and revenues were $10.3 billion, down from $12.3 billion, or 16%, in the second quarter of 2015.

"I'm pleased with our financial performance and focus on our long-term strategy given the difficult economic and industry environment we're facing. Our goal when sales decrease is to lower costs so the decline in operating profit is no more than 25-30% of the decline in sales and revenues. For the quarter, our decremental operating profit pull through was better than our target range. Together with our dealers, we're having success managing through the downturn in industries like mining and oil and gas, and in sluggish economic conditions in much of the developing world. In what is likely to be our fourth down year for sales and revenues, we're proud of what we're accomplishing – our machine market position has increased, including in China, product quality continues to be at high levels, and the safety in our facilities is world class," says Caterpillar Chairman and Chief Executive Officer Doug Oberhelman.

2016 Outlook

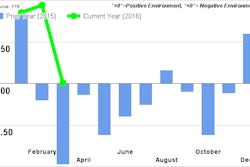

World economic growth remains subdued and is not sufficient to drive improvement in most of the industries and markets Caterpillar serves. Commodity prices appear to have stabilized, but at low levels. Global uncertainty continues, and the recent Brexit outcome and the turmoil in Turkey add to risks, especially in Europe.

The outlook for 2016 that Caterpillar provided with its first-quarter financial results in April expected sales and revenues in a range of $40-$42 billion. At the midpoint of that range, profit was expected to be $3.00 per share, or $3.70 per share excluding restructuring costs. Over the past quarter, economic risks have persisted and, as a result, the company's current expectations for 2016 sales and revenues are closer to the bottom end of that outlook range.

Restructuring costs in 2016, which were expected to be about $550 million, are now forecast to be about $700 million, or about $0.80 per share. Additional workforce reductions expected in the second half of 2016 are the primary reason for the increase in restructuring costs. Sales and revenues for 2016 are expected to be in a range of $40.0-$40.5 billion, and the profit outlook at the midpoint of the sales and revenues range is about $2.75 per share, or about $3.55 per share excluding restructuring costs. The revised outlook for both sales and revenues and profit per share excluding restructuring costs is in line with the Thompson First Call analyst consensus.

"Despite a solid second quarter, we're cautious as we enter the second half of the year. We're not expecting an upturn in important industries like mining, oil and gas and rail to happen this year. We're continuing significant restructuring plans, which are designed to bring our cost structure more in line with demand while maintaining our capability to quickly serve our customers when our business recovers. Once it does recover, we expect substantial incremental profit improvement, realizing the benefits of the tough actions we're implementing now coupled with our ongoing investments in products and digital capabilities. Amidst these very challenging market conditions, our balance sheet remains strong, and our employees are delivering better performance on everything from safety, quality and cost management to machine market position. I'm inspired by our people as they're the primary reason we're weathering this downturn as successfully as we are," says Oberhelman.

Highlights

- Second-quarter sales and revenues and profit were better than expected

- Cost reduction efforts are paying off with second-quarter decremental operating profit pull through better than the target range

- Mining, oil and gas, and rail industries remain challenged

- Revised outlook for 2016 is in line with analyst estimates

- Strong balance sheet – Maintained $0.77 per share dividend (announced June 8, 2016)

![Hcm Ax Landcros Press Release[32] jpg](https://img.oemoffhighway.com/mindful/acbm/workspaces/default/uploads/2025/11/hcmaxlandcros-press-release32jpg.mAEgsolr89.jpg?auto=format%2Ccompress&fit=crop&h=100&q=70&w=100)

![Hcm Ax Landcros Press Release[32] jpg](https://img.oemoffhighway.com/mindful/acbm/workspaces/default/uploads/2025/11/hcmaxlandcros-press-release32jpg.mAEgsolr89.jpg?ar=16%3A9&auto=format%2Ccompress&fit=crop&h=135&q=70&w=240)