After several years of falling equipment sales and stagnant low commodity prices, the agricultural market is finally showing consistent signs of life in several regions and sectors. According to a report by Power Systems Research, the agricultural segment could see a 2% gain in 2017 after a disappointing recovery rate in 2016 following the severe worldwide slump in 2014 and 2015 (learn more, 20862955).

Power Systems Research notes the overall market hit bottom between late 2015 and 2016, especially lower horsepower units which saw double digit growth in sales in 2016 versus 2015. Unfortunately, higher horsepower machines continued to decline in 2016, only reaching its bottom in the second half of 2016, and is not expected to have any significant growth in 2017, but rather remain flat.

Commodity prices still remain at a record low, so there is no anticipation of a rapid recovery. Instead, Power Systems Research predicts the recovery will continue to be very slow and the market will not reach its prior levels in the foreseeable future.

Providing a more long-term perspective, Grand View Research recently asserted that the global agricultural equipment market would be worth $243.4 billion by 2025. The firm notes that the rising population has escalated the demand for food and anticipates it to be one of the key drivers of increased ag equipment demand for the next several years (read more, 20860794).

Another key influencer to market demand is the increased adoption of technology in ag equipment as farmers strive to increase yield to match the anticipated food demand. The technological advancements in agriculture automation and robotics are fueling the adoption of farm equipment across the globe. And mechanization continues to be a driver for developing nations like India, China and Brazil.

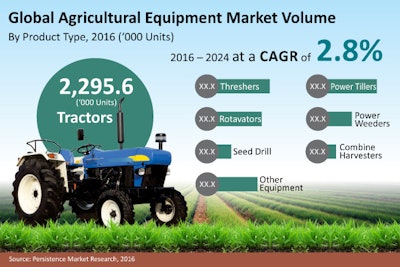

Persistence Market Research is not so robust with its long-term view as Grand View Research, predicting the global ag equipment market will only reach $131.6 billion by 2024 (learn more, 20857117). The discrepancy seems connected to Persistence’s projected annual growth rate of 2.8% versus Grand View’s 7% CAGR. In addition, Persistence also notes that high interest rates for the purchase of new agricultural equipment are becoming major hurdle for farmers around the world. Inflated fuel prices in some regions will also impede faster sales rates.

A regional analysis of the global agricultural equipment market, compiled in the report, projects dominance of North America. With more than one-third share of global revenues throughout the forecast period, North America will remain the most lucrative agricultural equipment market. Meanwhile, the agricultural equipment market in Middle East & Africa (MEA) is expected to showcase a value CAGR of 4.3%. Latin America, Europe and Asia-Pacific are also expected to be observed as leading regions for overall expansion of the global agricultural equipment market.

Europe

Earlier in 2017, CEMA (an association representing the European Agricultural Machinery) reported that in 2016, the European agricultural tractor market had declined 6.7% compared to 2015. In Europe’s two largest markets, Germany and France, demand for equipment dropped by 10.8% and 6%. Smaller European markets like Spain and Croatia saw growth, but not enough to pull the overall European market into positive growth.

A short time later in March of 2017, stable demand for the remainder of 2017 was anticipated for Europe’s ag market, and specifically the arable farm equipment segment. “The European market for arable farm equipment in 2016 is a picture full of contrasts,” says Nina Janßen, Coordinator of the CEMA Product Groups. Some Eastern European markets, particularly Russia and the Ukraine, enjoyed significant growth rates, especially in sales of field sprayers and precision seed drills. Growth in these markets partially compensated the decline of orders from other countries (learn more, 20856185).

Massive declines in sales were recorded for France and Poland for very different reasons. In France, a poor harvest caused liquidity shortages among farmers while in Poland blocked subsidy payments exerted a negative impact on farmers’ ability to invest in new arable equipment.

CEMA’s most recent report anticipates a return to growth for the European farm machinery market in 2017 (read more, 20861439). As an overall trend, sales of smaller tractors below 50 hp and sales of larger tractors above 150 hp are increasing while demand for most power categories in between is weak. Demand for balers, mowers, sprayers, combine and forage harvests is also expected to decrease in 2017.

DLG, the German Agricultural Society, conducted a survey to determine how European farmers were feeling about the agricultural climate, and the results were positive (read more, 20862982). Both the current economic climate and expectations of business growth are viewed in a far more positive light than in autumn of 2016. There is also a renewed willingness to invest, according to the survey results.

Farmers in all four countries surveyed, Germany, Poland, France and the U.K., are significantly more confident about business growth in the next 12 months, and there is indication that demand will continue to be strong. Emerging countries in particular will benefit due to rising raw material prices boosting economic development and stimulating global demand for agricultural products.

Despite the uncertainties surrounding Brexit and its impact on agricultural policies, farmers in the U.K. are also optimistic about business growth in the next 12 months. They hope that Brexit will cut red tape and give businesses more decision-making autonomy, which could strengthen the competitiveness of producers. In addition to these mid-term expectations, favorable financial terms and the weak pound add to the favorable conditions for British agriculture. In the light of a more favorable economic environment, British farmers are preparing for their exit from the EU and strengthening their competitiveness through investments.

The economic turnaround has significantly boosted the appetite for investment among farmers surveyed in Germany, France, Poland and the U.K. In Germany, 42% of farmers surveyed plan to invest within the next 12 months (+10% compared with autumn 2016), 45% in Poland (+7%), 50% in the U.K. (+16%) and 22% in France (+8%).

On the cusp of change

One broad trend that is taking over the agriculture machinery market, and has been for years, has been technology. Autonomously driven tractors, for example, have been common and in use for years in farming. To put it in perspective, an IDTechEx report, Agriculture Robots and Drones 2017-2027: Technologies, Markets, Players, predicted the number of GPS-enabled assets in farming will rise to nearly one million by 2024. In 2006, the industry only held 107,000 autonomously driven vehicles, and that number had ballooned to nearly 430,000 by 2016 (learn more, 20862505).

A more recent prediction by IDTechEx suggests that agricultural robots and drones will become a $12 billion industry by 2027. This is however on the cusp of change. Agricultural robots and drones will help drive this transformation. Here, sensor-equipped agricultural robots will autonomously navigate through farms, continuously building up a detailed spatial map of data about specific plants.

So, while some regions adopt precision data products and robotics, other regions of the world are working on increasing mechanization. These starkly contrasted paths in agriculture will need to be monitored closely and separately to ensure the global marketplace’s specific demands are being delivered and addressed.