In the release of its Commercial Vehicle Dealer Digest, ACT Research noted that expectations for the Class 8 and trailer markets anticipate a pullback in build rates, as market conditions continue to deteriorate. While less cliff-like, medium-duty market indicators continue to support a modest correction into 2020.

The report, which combines ACT’s proprietary data analysis from a wide variety of industry sources, paints a comprehensive picture of trends impacting transportation and commercial vehicle markets. This monthly report includes a relevant but high-level forecast summary, complete with transportation insights for use by commercial vehicle dealer executives, reviewing top-level considerations such as for-hire indices, freight, heavy- and medium-duty segments, the total U.S. trailer market, used truck sales information, and a review of the U.S. macro economy.

“Since early 2018, ACT’s forecasts have called for the up-cycle in the Class 8 market to run out of steam around the third quarter of 2019. Over the past couple of quarters, we have been beating the drum loudly so that our customers could be as well positioned as possible for when the downturn in industry activity inevitably occurred,” says Steve Tam, ACT’s Vice President. He continues, “Starting around 6 weeks ago, we began to see announcements of staffing reductions and plant shutdowns from OEMs, as well as from major tier-one suppliers. Anecdotes suggest the lower tiers on the supply chain have experienced production volumes cuts since early in September.”

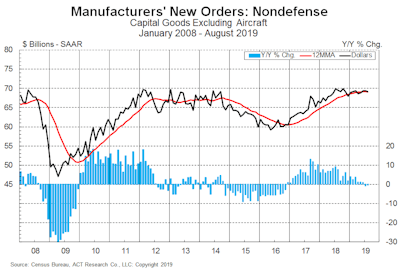

Tam adds, “The manufacturing sector is a critical source of freight generation. From raw materials to components to sub-assemblies and finally to the creation of complex machinery, there is much truck freight involved in the movement of small pieces to build large things.” He concludes, “The forward-looking Manufacturers’ New Orders, Nondefense Capital Goods (ex aircraft), a look at demand for freight-intensive durable goods, shows durable goods orders have stagnated in 2019 and have been negative year-over-year for the past 2 months. The lack of traction on the front side does not speak well for a near-term recovery in industrial activity.”