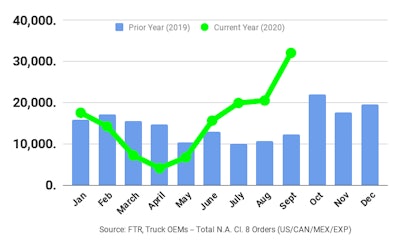

Preliminary North American Class 8 net orders rose again in September 2020. Orders were over 30,000 units and increased compared to the previous month as well as the same period in 2019.

FTR reports orders reached 32,000 units in September, and order activity was up 55% month-over-month (m/m) and 160% y/y. Class 8 net orders for the last 12 months now total 197,000 units.

ACT Research, meanwhile, reports orders were at 31,100 units in September for a 60% increase from August and a 145% rise on a year-ago comparison. The NA Classes 5-7 market also saw orders at a healthy 26,900 units, up 37% month-over-month and 48% versus their year-ago September volume.

Complete industry data for September, including final order numbers, will be available from both research firms later in the month.

According to FTR, fleets have renewed confidence, and the stronger than expected economic and freight recovery is spurring equipment orders. The orders are a combination of growing replacement demand and some expansion demand in those regions where capacity is tightening. The uncertainty about the pandemic continues to fade, as more sectors of the economy reopen and consumer mobility increases.

FTR

FTR

Don Ake, Vice President of Commercial Vehicles for FTR, comments, “The Class 8 truck market continues to recover faster and better than expected. This strong order volume suggests fleets believe there will be steady freight growth going forward. Rates have improved, so carriers have the cash, and now they also have the confidence. When you combine those two factors, orders tend to surge.

“There was considerable pent-up demand in the market, as orders sank in the March to May time period. So, trucks that would have normally been ordered then, are being ordered now, since much of the risk has passed. The order volume is very close to August’s trailer orders; therefore, it appears that the fleets took care of their trailer needs first, and then caught up to the truck side in September. Ordering for 2021 deliveries will begin in earnest this month, so the industry has solid momentum going into the fall ordering season.

“This is still a risk-filled environment, with some of that uncertainty having intensified recently. But many fleets are focused on future business prospects and are willing to assume the short-term risks for long-term gains.”

“Preliminary data show that September orders for medium- and heavy-duty vehicles posted positive readings for a fourth consecutive month, after 19 consecutive months of negative year-over-year comparisons,” says Kenny Vieth, ACT’s President and Senior Analyst. He continues, “In aggregate, Classes 5-8 orders rose 49% from August and improved 88% compared to year-ago September.”

Relating these facts to the North American heavy-duty market, Vieth says, “As orders rebounded to relatively healthy levels early in Q3, most of those orders were targeted at filling open 2020 build slots. With most of that work done by the end of August, we suspect the lion’s share of September’s orders were booked into 2021.”

Regarding the medium-duty market, Vieth comments, “There is a symbiotic relationship between heavy-duty freight rates and medium-duty demand, and clearly, the shift in consumer spending from experiences [services] to goods has been good for the providers of local trucking services.”