Enrique Busquets, director of mobile services & aftermarket for Bosch RexrothBosch Rexroth

Enrique Busquets, director of mobile services & aftermarket for Bosch RexrothBosch Rexroth

1. What challenges most affected the mobile OEM landscape in 2024?

The mobile OEM landscape has been significantly influenced by the slowdown in agriculture, coming down from a peak in 2022, and construction, which has consequently resulted in elevated inventory equipment levels. Factoring in addition the increased interest rates, elevated inflation levels, a major election, and an ever-increasing shortage of labor, 2024 has been a challenging year for several sectors in the mobile market.

2. What are your predictions for the mobile OEM landscape in 2025?

In 2025, the mobile OEM landscape is poised to start off with the same challenges the industry has experienced in 2024, which will steer OEMs to focus on cost reduction efforts, as well as high sales efforts. This might be a chance for OEMs to focus on technological advancements that simplify production and operational costs, improve equipment unique selling points, and pushes beyond the delivered machine productivity levels.

3. In what area(s) do you see the most potential for acceleration or advancement in 2025?

First and foremost, increasing the level of electronic-controlled functions has a tremendous potential to enable OEMs reach their goals and deliver end-user higher value in their operations.

Additionally, automation within fleet management has enormous potential for OEMs, not only in system-wide monitoring and establishing operational standards, but in reallocating resources to different areas of the company. Tasks that perhaps took multiple operators previously can perhaps be done with one or two now thanks to strategic automation.

4. What will be the biggest challenge for OEMs and the industry in general in 2025?

Many OEMs are reticent to move away from processes that they’ve used for decades. While those protocols have undoubtedly proven their worth and fueled the company’s success to this point, technology is advancing at such a pace that OEMs who don’t consider some level of integration will soon be at a disadvantage of their competitors who have already started to introduce it into their operations.

5. What factors should engineers and their companies consider when making decisions in the mobile OEM space in 2025?

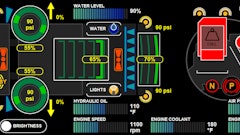

Data monitoring is a critical component to nearly every process and it’s having a significant impact on operational monitoring. Moreover, how those solutions communicate with other components within a system and the subsequent data that’s produced is just as vital. It’s imperative for companies to prioritize solutions that offer real-time metrics which can ultimately guide strategic action.

6. Please highlight a recently introduced product from your company that meets a specific, pressing need in the mobile OEM space, and describe briefly how the product is uniquely designed to meet that need.

One of the aspects we have focused on is the use of software to reduce machine production costs, while adding value- and comfort for the end-user. One such case is our next generation active ride control for wheeled and tracked loaders. This advanced system, not only simplifies the machine architecture, thereby reducing machine production costs and production cycle times, but also results in higher levels of operator comfort.

7. What are some of your company's priorities in 2025 with regard to electrification, automation, innovation, emission reduction and/or other emerging trends?

We’re constantly encouraging companies to view their operations as a cohesive ecosystem that communicates clearly within itself. Electrification will clearly be one of the central focuses for many next year, but it’s how those electrified components communicate with the machine, the operator, and the system as a whole that is at the heart of this industry shift. Additional priorities do include a continued focus on sustainability and eco-friendly tactics, especially as the market in the United States continues to establish and incorporate a growing number of industry policies and regulations.