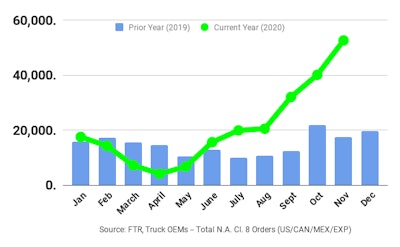

Preliminary North American Class 8 net orders were up about 30% in November 2020 compared to the previous month, reaching a total of over 50,000 units.

FTR reports orders reached 52,600 units, the best Class 8 order activity since August 2018. It says orders were up 31% month-over-month (m/m) and almost three times the level of November 2019. Class 8 orders for the past 12 months continue to increase and now stand at 250,000 units.

ACT Research, however, puts November 2020 orders at 51,900 units, up 33% from October and a 197% improvement from year-ago November. It also notes Classes 5-7 orders reached 27,200 units. That order volume represents a 9% decrease from October’s 30-month high, but was still up 78% compared to last year.

Final order numbers will be available from both research firms later in December.

According to FTR, the tremendous volume reflects several large fleets placing their requirement orders for the entirety of 2021 to lock up build slots, which they perceive could be in short supply next year. Fleet confidence remains solid entering 2021, as carriers are getting their truck orders in early for next year's deliveries. Consumer-oriented freight remains vibrant and industrial freight is expected to improve in the coming months. Fleets are placing big orders anticipating needing more trucks throughout next year.

Orders should begin to wind down in the next several months as the large fleets conclude their seasonal ordering. The November orders are great news for the industry. These orders are pumping up the backlog which had dropped to a 3-year low in September. The higher backlog would indicate that the industry will have a stable, positive year in 2021. This will be a welcome relief after the shock and chaos of 2020.

FTR

FTR

Don Ake, Vice President of Commercial Vehicles for FTR, comments, “The Class 8 market is trying to rebalance after suffering through woeful order numbers early in the pandemic. The huge November orders mean that Q4 will be a fabulous one, regardless of what comes in for December and that portends well for the expected increase in production early next year.

“Fleets are still trying to catch-up with the jump in freight volumes resulting from the economic restart and the generous stimulus money which is being spent predominately on consumer goods and food. This will only intensify if there is a second round of payouts.”

“The pandemic-impacted economy continues to play into the hands of trucking,” says Kenny Vieth, ACT’s President and Senior Analyst. “With freight rates surging to record levels the past three months and carrier profits certain to follow, orders accelerated in November. Preliminarily, North American Class 8 net orders rose to the third highest level in history, proving once again our favorite commercial vehicle demand axiom, when carriers make money, they buy, or at least order, trucks.”

Regarding the medium-duty market, Vieth comments, “There is a symbiotic relationship between heavy-duty freight rates and medium-duty demand. Clearly, the shift in consumer spending from experiences to goods has been good for the providers of local trucking services as e-commerce has grown by leaps and bounds during the pandemic.”