SSAB announces its second quarter 2019 financial reults.

The second quarter :

- Sales were SEK 20,654 (19,263) million

- Operating profit before depreciation/amortization was SEK 2,419 (2,582) million

- Operating profit was SEK 1,316 (1,630) million

- Earnings per share were SEK 0.98 (1.27)

- Operating cash flow was SEK 1,696 (1,325) million

- Net debt/equity ratio was 16% (20%), excluding IFRS 16

Comments by the CEO

"SSAB’s operating profit for the second quarter of 2019 was SEK 1,316 million, down SEK 314 million compared with the second quarter of 2018. Lower earnings were attributable to SSAB Europe, which was affected primarily by higher iron ore costs. Group operating cash flow increased to SEK 1,696 (1,325) million.

"Demand for SSAB Special Steels was good during the quarter. Operating profit was somewhat higher than a year earlier at SEK 544 (522) million. Higher realized prices were largely counteracted by higher iron ore costs.

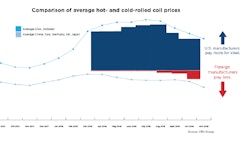

"Demand in Europe weakened during the second quarter and SSAB Europe’s shipments were down compared to last year. This was primarily due to weaker demand from the automotive industry. Operating profit dropped to SEK 66 (907) million. A sharp rise in iron ore prices and weaker steel prices have resulted in exceptional pressure on margins on the European market.

"Second quarter operating profit for SSAB Americas rose to SEK 872 (365) million. This improvement was driven by significantly higher realized prices and lower scrap metal prices compared to the second quarter last year. Demand was good in most customer segments, although the sentiment at distributors is cautious.

"There is some uncertainty as to how the business cycle will develop looking ahead. Weaker steel prices on our home markets, Europe and the USA, imply a cautious sentiment at distributors and demand is expected to be seasonally weaker during the third quarter. The current staffing level is aligned with a relatively high production rate, with a large number of temporary employees, which gives us flexibility when the market slows down. During the third quarter, the production volume will be lower and the number of temporary employees will be reduced accordingly. Among other things, the smaller blast furnace in Oxelösund will be idled. In addition, already planned measures to cut other costs in all divisions are being carried out. At the same time, our strong balance sheet gives us a sound basis to continue to develop the company, regardless of business conditions," says SSAB’s President and CEO Martin Lindqvist.